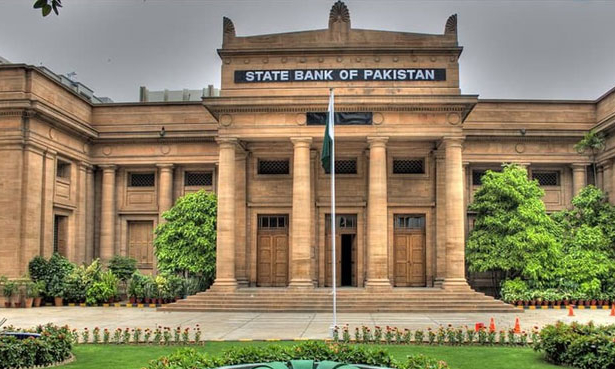

KARACHI: The State Bank of Pakistan (SBP) has scaled back its dollar buying from the interbank market in a move aimed at preserving liquidity and easing pressure on the exchange rate, according to currency dealers.

Compared to last year’s aggressive accumulation of $7.8 billion in foreign exchange reserves, the central bank’s current pace of dollar purchases has noticeably slowed. Dealers say the shift comes amid rising import demand and growing concerns over the widening trade deficit.

Although the rupee has held relatively steady in recent weeks, market analysts caution that this stability may be short-lived. If the current account records another deficit in September, it would mark three consecutive months in the red, signaling a deficit for the entire first quarter of fiscal year 2026.

“A continued deficit could strain the exchange rate and affect import flows,” said one dealer, noting that the recent easing of letter-of-credit restrictions has contributed to the expanding trade gap.

Pakistan’s trade deficit surged by 29 percent in July and August, with imports reaching $11 billion—more than double the $5 billion in exports. Imports grew by over 14 percent, while export growth remained below 1 percent.

You Might Also Like

Reasons behind Babar Azam’s removal as Captain revealed

JKLC secretary stresses Kashmiris can’t live without Pakistan

Youth is Pakistan’s bright future, says PA Speaker

High speed trains to roll out across Punjab as government gives go ahead to major projects

Faisal Mamsa, CEO of Tresmark, acknowledged the risks but pointed to regional developments that may offer some relief. “Pakistan’s position has improved through its defense agreement with Saudi Arabia and stronger ties with China,” he said. Mamsa also cited Panda bonds and the anticipated rollover of Chinese loans as potential buffers for the external account.

Still, rising food imports are raising eyebrows. Palm oil imports alone jumped 30 percent, while the broader food category saw a 37 percent increase during the two-month period. Analysts expect wheat and sugar imports to climb further in the coming months.

“This pattern suggests the current account will likely remain in deficit through September, increasing dollar demand and putting more pressure on the rupee,” said currency dealer Atif Ahmed.

Ahmed added that while regular inflows have remained stable, remittances have been buoyed by charitable donations and aid linked to flood relief, keeping monthly figures close to $3 billion.

Meanwhile, SBP’s foreign exchange reserves edged up by $22 million during the week ending September 19, reaching $14.379 billion. The central bank did not disclose the source of the inflows. Pakistan’s total liquid foreign reserves now stand at $19.793 billion, with commercial banks holding $5.413 billion.

As the country navigates a delicate economic landscape, the SBP’s cautious approach to dollar buying reflects an effort to balance reserve management with exchange rate stability.

We welcome your contributions! Submit your blogs, opinion pieces, press releases, news story pitches, and news features to spotpakistan25@gmail.com